Or they might go ahead and sell your debt to a collection agency for cheap because they’d rather get some money than nothing at all. They may hire a debt collector to pressure you into paying. At that point, your creditor (the person or business you owe money to) figures they aren’t likely to get any money from you. If you don’t pay on the bill within a certain amount of time (anywhere from 30 to 180 days after it’s due), it becomes delinquent debt. Well, let’s say you get a bill in the mail from a hospital because of a recent surgery. If you miss a payment, you run the risk of your debt going into collections. It doesn’t matter what type of debt you’ve got-credit cards, student loans, mortgages, medical bills, car loans, utility bills. What kinds of debt can go into collections?

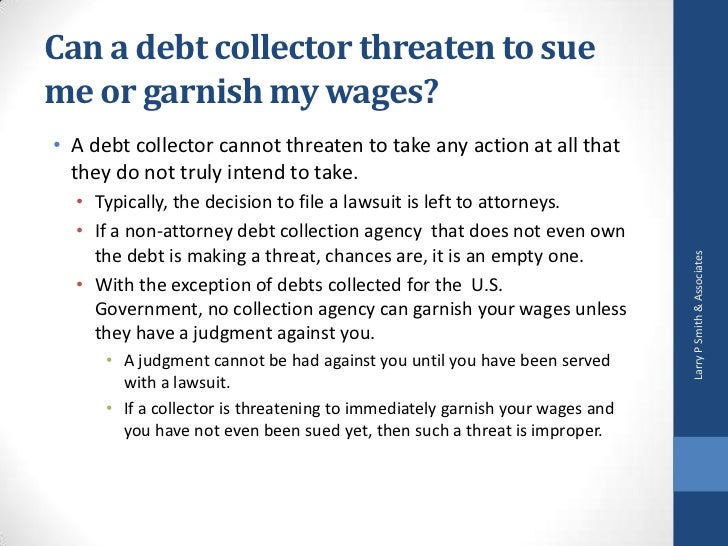

You just have to know the rules.īut to really understand how the FDCPA works, you first need to know what kinds of debt can go into collections and who has the right to collect it. A debt collector may talk a lot of smack, but there’s only so much they can actually do without breaking the law. Think of it like a wrestling match-if a debt collector is in one corner and you’re in the other, then the FDCPA is basically the referee. But it does keep them from doing some real shady stuff to get your money-like lying, threatening or manipulating. Now, here’s the thing: The FDCPA doesn’t stop debt collectors from asking for the debt you owe them (that’s totally legal). The Fair Debt Collection Practices Act (FDCPA) set some strict rules on how debt collectors can talk and behave when they’re trying to collect money from you.

#Fair debt collection practices act how to

Here’s how to get those collectors and your debt out of your life for good! What Is the Fair Debt Collection Practices Act? Knowing exactly what debt collectors can and can’t do will help you take charge of your situation. 1 But thanks to the Fair Debt Collection Practices Act, you have more power than you think. More than one in four people who use credit have at least one debt in collections.

If you’re afraid to answer the phone because you’ve got a debt collector hounding you, you’re not alone. As soon as you see the number, you start to sweat.

Our firm is very familiar with all aspects of the FDCPA, and we can provide our clients with a defense to any claim made against them with regard to an alleged violation.The phone rings. If, however, you find yourself defending a FDCPA claim, knowing the law, recognizing the form complaints available on the internet, and acting quickly can be the difference between a nominal settlement and a substantial judgment. This is an arena where an ounce of prevention is much more effective than a pound of cure. With a strict liability statute, statutory damages, and rising attorneys fees, FDCPA claims can become quite costly. The law restricts certain collection activity from debt collectors, and it subjects creditors to monetary sanctions if the law is violated in even the smallest instance.Īcting quickly can be the difference between a nominal settlement and a substantial judgment.Ĭonsumers are more educated than ever when it comes to the FDCPA. The federal Fair Debt Collection Practices Act (“FDCPA”) is oven invoked by debtors who claim that a creditor has violated one of the many sections of the law.

0 kommentar(er)

0 kommentar(er)